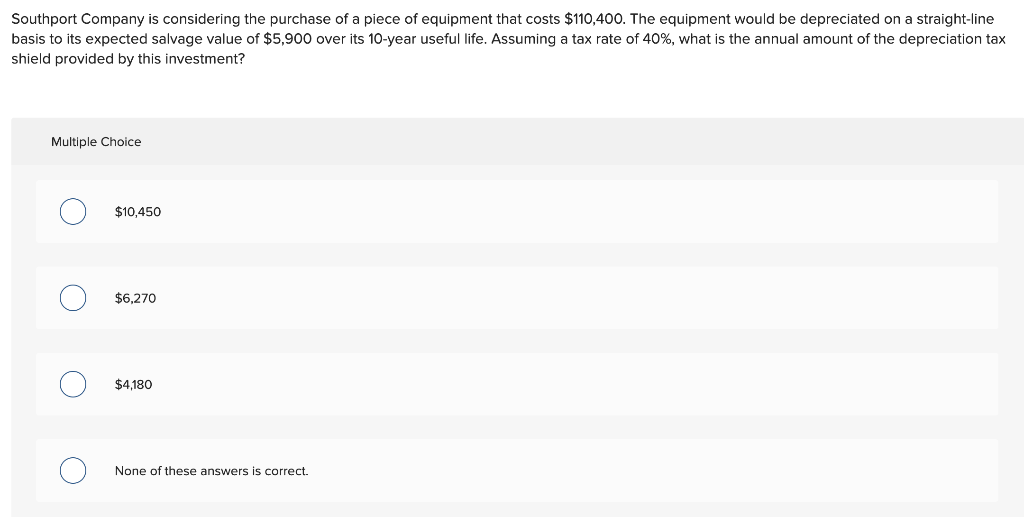

Capital expenditure (Capex)—with the cash flow generated from fixed asset over a period of time. A person buys a house with a mortgage and pays interest on that mortgage. That interest is tax deductible, which is offset against the person’s taxable income. It is the method companies use to allocate the cost of an asset, which may be machinery, building, etc., throughout its useful life. This is done because every asset is subject to a fall in value during usage due to continuous wear and tear. The cost allocation in the form of depreciation will ultimately ensure that the final value of the asset appearing in the financial statement will reflect its true and fair current value.

Straight-Line vs. Accelerated Depreciation Approaches

Therefore, the tax shield can be specifically represented as tax-deductible expenses. Tax shields allow for taxpayers to make deductions to their taxable income, which reduces their taxable income. The lower the taxable income, the lower the amount of taxes owed to the government, hence, tax savings for the taxpayer. Interest tax shield refers to the reduction in taxable income which results from allowability of interest expense as a deduction from taxable income. The most significant advantage of debt over equity is that debt capital carries significant tax advantages as compared to equity capital.

Example: Depreciation Method Tax Impacts

Let’s consider a practical example to see how a tax shield works in real life. Imagine a small business that invests in machinery for production purposes. The cost of the machinery is $50,000, and it has an expected useful life of 10 years.

FAR CPA Practice Questions: Debt Covenant Compliance Calculations

The difference in EBIT amounts to $2 million, entirely attributable to the depreciation expense. With the two methods clarified, let’s look at the Cash Flow impact of each approach. As a cost of borrowing, the borrower must make Interest payments for the benefit of borrowing.

What Is the Formula for Tax Shield?

The real cash outflow stemming from capital expenditures has already occurred, however in U.S. GAAP accounting, the expense is recorded and spread across multiple periods. Under U.S. GAAP, depreciation reduces the costing method: choosing the right one carefully book value of a company’s property, plant, and equipment (PP&E) over its estimated useful life. So, for instance, if you have $1,000 in mortgage interest and your tax rate is 24%, your tax shield will be $240.

Want To Learn More About Finance?

By doing so, you can make informed financial decisions and potentially better secure your financial future. Tax shields are essentially tools used to protect income from being taxable. They can take different forms, such as deductible expenses, tax credits, or depreciation allowances.

This means the business would have saved $15,000 in taxes due to the depreciation tax shield. In this post, we’ll dive into a concept that is essential for understanding tax planning and its impact on businesses and individuals alike – the tax shield. Whether you’re a business owner, investor, or simply interested in personal finance, understanding what a tax shield is and how to calculate it can help you make more informed financial decisions. Tax shields are an important aspect of business valuation and vary from country to country.

- The business operation will involve the use of assets of larger value resulting in a substantial amount of depreciation being deducted from the taxable income.

- The Life of Solar Power Plant is considered as 25 Years, but in this example, we have considered the time period for 4 years only.

- The recognition of depreciation causes a reduction to the pre-tax income (or earnings before taxes, “EBT”) for each period, thereby effectively creating a tax benefit.

- Depreciation tax shields are important because they can improve a company’s cash flow by reducing its tax liability.

The use of a depreciation tax shield is most applicable in asset-intensive industries, where there are large amounts of fixed assets that can be depreciated. Conversely, a services business may have few (if any) fixed assets, and so will not have a material amount of depreciation to employ as a tax shield. The intuition here is that the company has an $800,000 reduction in taxable income since the interest expense is deductible. An alternative approach called adjusted present value (APV) discounts interest tax shield separately. Even though the APV method is a bit complex, it is more flexible because it allows us to factor-in the risk inherent in admissibility of interest tax shield.